In a city famous for its bright lights and big risks, Las Vegas residents might be taking a bigger gamble than they realize—they’re risking their homes.

In 2024, with the U.S. facing an unprecedented number of natural disasters—nearly 100 catastrophic events, including severe thunderstorms, wildfires, and floods—insurance coverage, which once served as a strong shield against nature’s fury. Many major insurance companies are pulling back from offering essential coverage in high-risk areas, leaving homeowners in places like Las Vegas wondering if their protection is as reliable as it used to be.

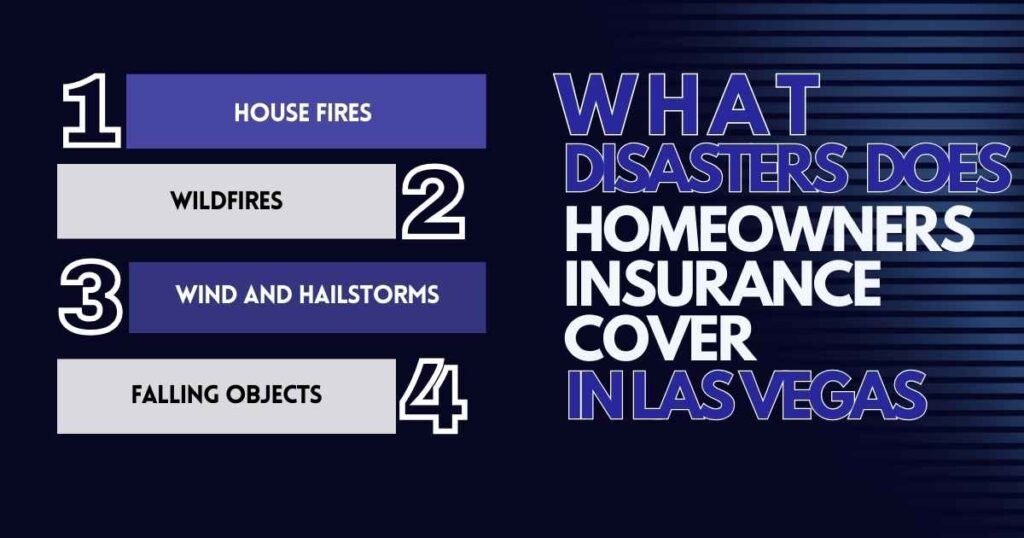

What Disasters Does Homeowners Insurance Cover in Las Vegas?

In Las Vegas, homeowners insurance typically covers a range of disasters, providing protection against several potential risks. While specific coverage can vary depending on the policy, most standard homeowners insurance in Las Vegas generally covers:

- House Fires: Including accidental fires, such as those starting in the kitchen.

- Wildfires: Protection against damage from wildfires, which can occur in surrounding areas.

- Wind and Hailstorms: Coverage for damage caused by strong winds and hail, which can occur during severe weather.

- Falling Objects: This includes coverage for damage from falling tree branches or other debris.

However, it’s important to note that some natural disasters, like earthquakes and floods, are often not included in standard homeowners insurance policies in Las Vegas. Homeowners may need to purchase additional coverage for these specific risks.

To ensure you’re fully protected, it’s advisable to review your insurance policy and consider any additional coverage that might be necessary based on the unique risks in Las Vegas.

What Disasters Aren’t Covered by Homeowners Insurance in Las Vegas?

While homeowners insurance in Las Vegas provides protection against many common disasters, there are several risks that are typically not included in a standard policy. When considering natural disasters insurance, homeowners should be aware that the following disasters and situations generally fall outside the scope of standard coverage:

1. Floods

Standard homeowners insurance policies do not cover flood damage, which can occur due to heavy rains, flash floods, or the overflow of bodies of water. To protect your home from flood damage, especially in flood-prone areas, you’ll need to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer.

2. Earthquakes

Earthquake damage, including damage from aftershocks, is not covered by standard homeowners insurance. Nevada, including Las Vegas, is seismically active, making earthquake insurance a wise consideration for homeowners. This coverage can be purchased as an add-on to your existing policy or through a separate policy.

3. Landslides and Mudslides

Just like earthquakes, landslides and mudslides are not covered by standard insurance policies. These events can cause severe structural damage, especially in areas with unstable or steep terrain.

If you live in a region prone to landslides, you may need to buy extra insurance to protect your home from this risk. Without this additional coverage, you could face significant out-of-pocket costs to repair your home if a landslide occurs.

4. Sewer Backups and Drain Overflows

Damage caused by sewer backups or overflowing drains is usually not included in standard homeowners insurance policies. These types of incidents can lead to expensive repairs, as they can cause water damage, mold growth, and contamination in your home.

However, many insurance companies offer optional add-ons, known as endorsements or riders, that you can include in your policy to cover these risks. Adding this coverage can provide peace of mind and financial protection in case of a sewer or drain problem.

5. Sinkholes

Although sinkholes are not common in Las Vegas, they can still happen and cause catastrophic damage if they do. A sinkhole can suddenly appear, swallowing part of your property and causing serious harm to your home.

Standard homeowners insurance policies do not cover damage from sinkholes, so if you live in an area where this risk exists, you may need to purchase special sinkhole insurance. This type of policy can help cover the costs of repairing or rebuilding your home if a sinkhole causes damage.

6. Mold, Rot, and Pest Infestations

Damage caused by mold, rot, or pests like termites is usually not covered by homeowners insurance because it’s seen as a result of poor maintenance. These issues can slowly damage your home over time, often without you noticing until it’s too late.

To avoid costly repairs, it’s important to take preventative steps, such as keeping your home dry and well-ventilated, regularly checking for leaks, and having your home inspected for pests. Regular maintenance and quick action when you spot potential problems are the best ways to protect your home from this kind of damage.

7. Business-Related Damages

If you operate a business from your home, damage related to business activities may not be covered under a standard homeowners policy. You may need separate business insurance to protect against these risks.

Given the exclusions in standard policies, it’s important for homeowners in Las Vegas to carefully review their insurance coverage and consider purchasing additional policies or endorsements to ensure comprehensive protection. Understanding the specific risks in your area and addressing any gaps in coverage can help safeguard your home against unforeseen disasters.

6 Ways to Take When Facing Damage From a Natural Disaster in Las Vegas

1. Contact Your Homeowners Insurance Provider

As soon as your home is damaged, get in touch with your insurance agent or company to discuss your homeowners insurance coverage. If your home is unlivable, ask about the additional living expenses coverage in your policy.

This coverage, known as loss of use, helps pay for things like hotel stays, meals, and storage. Keep all receipts for these expenses to make it easier to claim reimbursement.

2. Assess and Document the Damage

Take pictures of the damage to your home and belongings. Make notes about the type of damage, the estimated value, and when you bought the items. This documentation will be important when making an insurance claim. Keeping a home inventory can also make the claims process smoother.

3. Ask Your Insurance Company Questions

Get clear answers from your insurance provider by asking questions such as:

- Can I start cleaning up?

- Is it okay to begin repairs?

- Should I get repair estimates?

- What is the deadline for filing my claim(s)?

- What documents do I need to complete my claim?

- What is my deductible?

4. Keep a Home Insurance Claim Journal

Create a detailed record of all paperwork related to your home insurance natural disaster claim. Keep track of receipts, photos, videos, and all communications with your insurance company. Record dates, names, and details of conversations for easy reference.

5. Review Your Homeowners Insurance Policy

Take time to understand your home insurance policy, including the types of coverage and limits. If you don’t have a copy of your policy, ask your insurance agent or company for one. Knowing the details of your policy will help you understand what compensation you’re entitled to and your maximum payout.

6. Register for Disaster Assistance

If your home is damaged by a natural disaster, register for help at disasterassistance.gov. Provide key information like your home address, where you’re currently staying, Social Security number, insurance details, income, a description of the damage, and banking information for direct payments. You can also contact FEMA at 1-800-621-FEMA (3362) or visit a Disaster Recovery Center (DRC).

Smart Choices for Natural Disaster Insurance

Understanding insurance coverage for natural disasters helps people prepare for unexpected events and make smart decisions about protecting their finances. Knowing what is covered and what isn’t allows homeowners to assess their risks, avoid gaps in coverage, and plan for any additional protection they might need.

Getting advice from experts about natural disaster insurance is important because it ensures that people get accurate information tailored to their specific needs. Professionals like Vegas Plumbing Pros can help you choose the right coverage limits, understand what your policy excludes, and navigate complex insurance terms. This guidance helps homeowners make informed decisions to protect their property and financial security.

Strengthen Your Shield!

While it’s comforting to know that your home is protected against many natural disasters, relying only on a basic insurance policy might leave you vulnerable to unexpected risks. Just like a weak umbrella doesn’t do much in a heavy storm, the security you get from your insurance is only as strong as the coverage it provides.

Taking a little time now to understand your insurance policy and adding extra coverage where needed can give you lasting peace of mind. Don’t wait until a disaster happens—take action today to protect your home and your future. Start small, but make sure you and your loved ones are fully prepared for whatever may come your way.

FAQs

What natural disasters are usually covered by homeowners insurance?

Homeowners insurance usually covers several natural disasters, such as wildfires, lightning strikes, windstorms, hailstorms, and volcanic eruptions. However, floods and earthquakes are generally not included in standard policies and require separate insurance.

Do I need separate insurance for flood and earthquake coverage?

Yes, flood and earthquake coverage are not typically included in standard homeowners insurance. To be protected from these events, you’ll need to buy separate flood insurance and earthquake insurance policies.

How much does flood insurance cost?

The cost of flood insurance depends on factors like the property’s location, flood risk, coverage amount, and the insurance provider. On average, flood insurance through the National Flood Insurance Program (NFIP) costs about $859 per year.

Are hurricanes covered by homeowners insurance?

Homeowners insurance usually covers damage from hurricanes, including wind damage and damage from related events like rain and hail. However, coverage can vary depending on your policy and location, especially in areas near the coast where hurricanes are more common.